SYT iQ Insight: Preview of the State of Yachting 2024

SuperYacht Times has released its annual The State of Yachting report, now available for download. This SYT iQ Insight article provides a glimpse into the comprehensive market data analysis and insights provided by the Intelligence Team at SuperYacht Times.

In 2023, the yacht industry witnessed a modest decline in the sales of both new and used yachts, yet figures remained higher than pre-pandemic levels. This observation raises an intriguing question: Have yacht sales reached a new, elevated baseline in the post-COVID era? Notably, throughout the year, stock markets in the United States and the Netherlands, the latter being the home base of SuperYacht Times, experienced substantial growth. This economic uptrend may have played a role in encouraging/bolstering prospective superyacht buyers.

Simultaneously, reports indicate that geopolitical tensions, particularly the escalation of armed conflict in the Middle East, have dampened, and continue to affect the enthusiasm of some prospective owners considering the purchase of large new-build yachts.

New and used yacht sales:

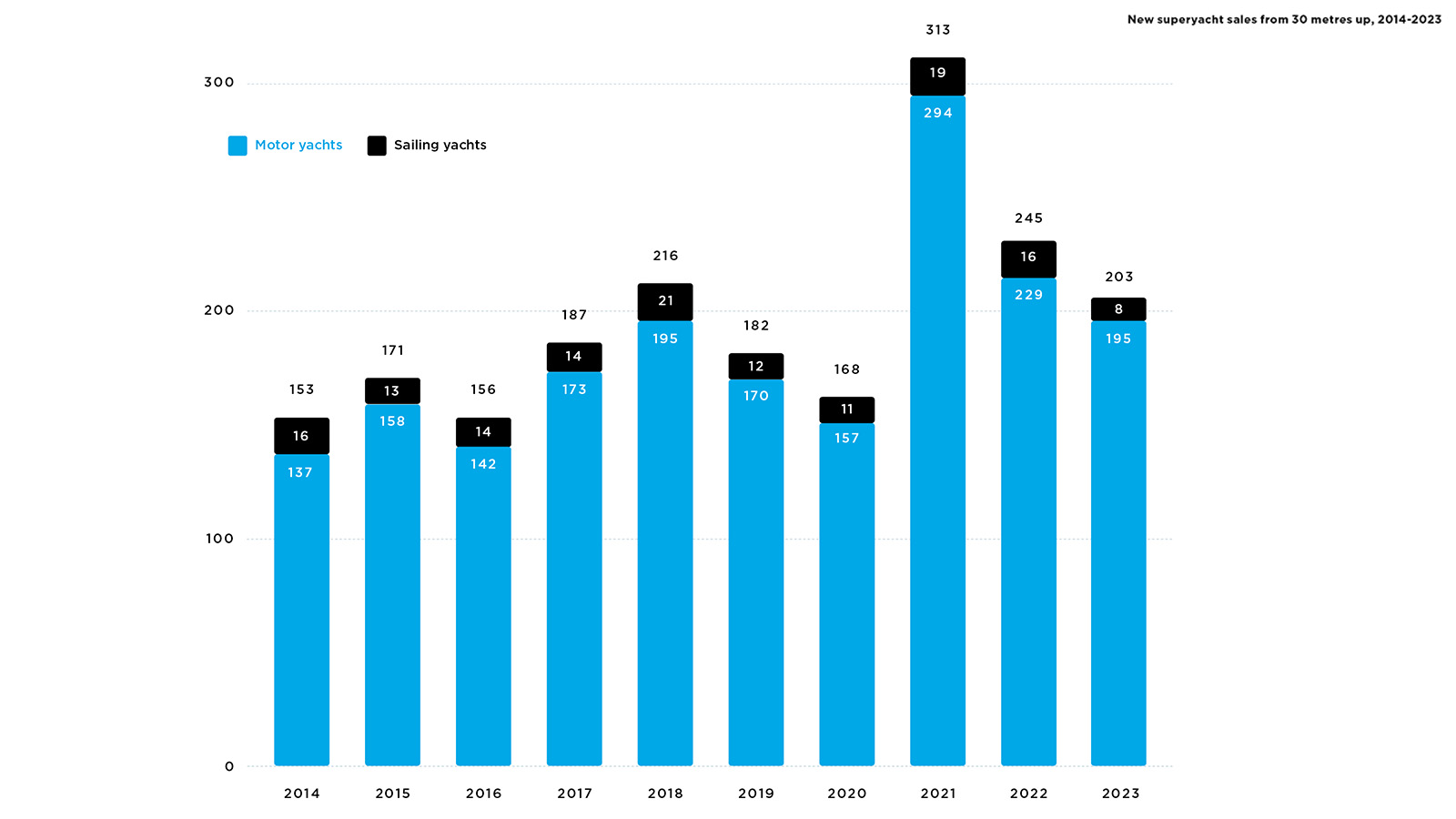

In 2023, the sale of new yachts over 30-metres totalled 203, marking a 17% decrease from the 245 units sold in 2022. Despite this substantial reduction, any figure surpassing 200 remains impressive by historical standards. Over the past two decades, the 2023 sales figure ranks seventh, trailing behind the boom in 2021/’22, the earlier peak from 2006 to 2008, and the year 2018.

In 2023, the used yacht market saw a 27% decline in sales, dropping from 403 in 2022 to 296. This downturn appears to represent a return to normalcy following the record-breaking sales figures observed in 2021 and 2022.

New Superyacht Completions:

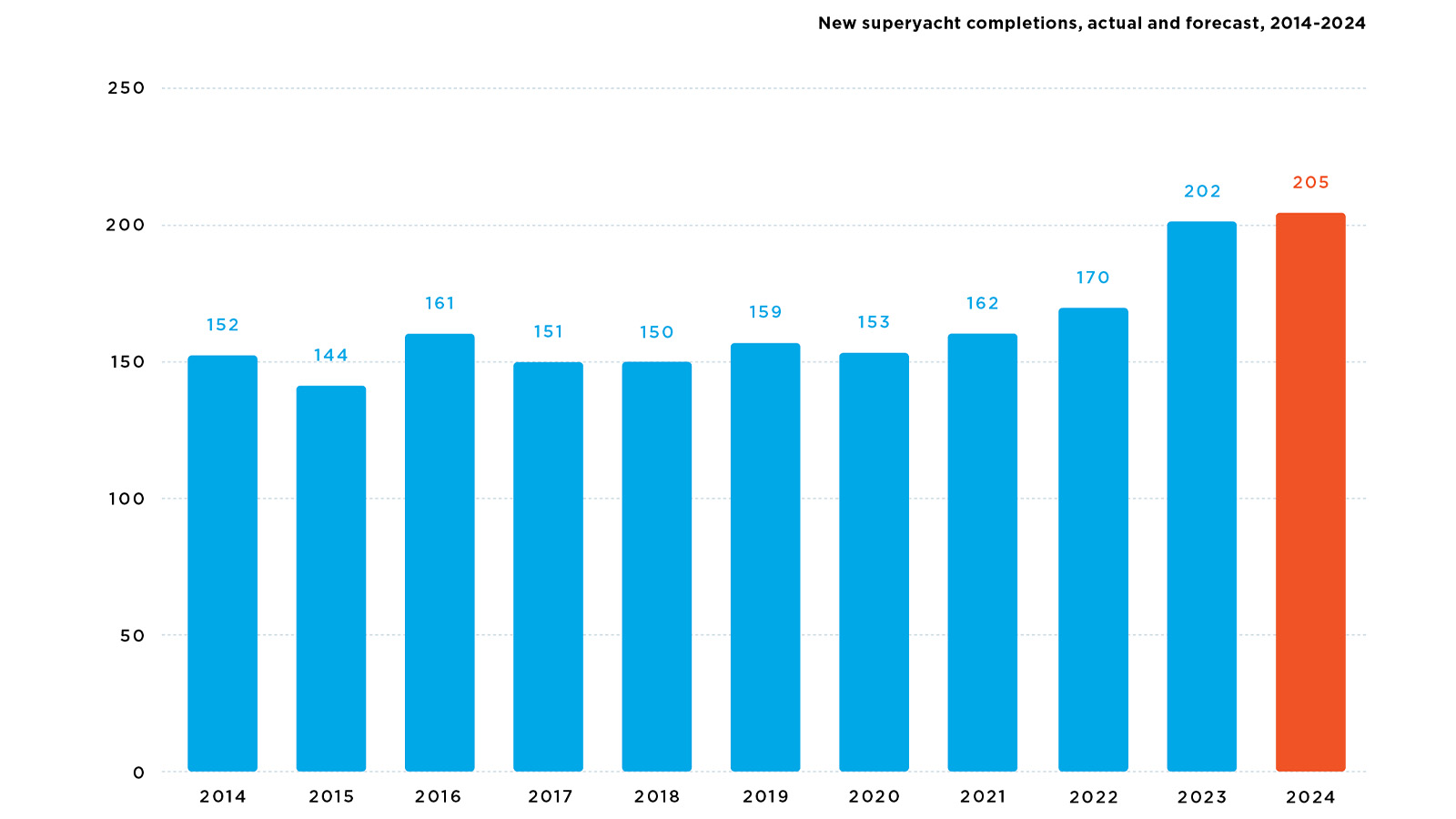

For several years, from 2014 to 2021, the number of new yacht completions annually fluctuated within a range of 150 to 160 units. In 2022, this figure rose to 170 completions, fueled by a surge in sales that began in the latter half of 2020. Anticipating the momentum from the robust sales in 2021 and 2022, we projected a further increase to around 190 completions for 2023, given the substantial order backlog. Surpassing our projections, the actual completions for 2023 not only met but exceeded our expectations, reaching a total of 202 yachts, as highlighted in the graph below.

Despite a strong year in terms of yacht completions, a significant order backlog persists. The State of Yachting 2023 reported an initial lineup of 352 yachts slated for potential completion within the year. However, only 202 yachts reached completion, indicating that 43% of the anticipated completions were postponed, a proportion consistent with the delay rate observed in 2022. Following a year of relatively high output, the industry anticipates the potential completion of 340 yachts in 2024, a considerable number of which are semi-custom models. The delivery timelines for these yachts are often not explicitly communicated. As new-build deliveries continue to rise, we anticipate that approximately 40% of yachts might be deferred to the following year, estimating about 205 new yacht completions over 30-metres in 2024. Given the shipyards’ demonstrated capacity in 2023 to deliver over 200 new-builds, such an expectation seems well-founded.

Their latest market report, ‘The State of Yachting 2024.’ This edition is now available for download on Superyacht Times website. Designed to serve both newcomers and experienced professionals within the industry, this report delivers all essential insights and information pertaining to the superyacht market.

Written by Enrico Chhibber

Share

COME AND MEET US: YOU’RE INVITED!

Headquarters

Mark Cavendish Chief Commercial Officer

| Robert Drontmann Sales Director

| Sara Gioanola PR & Press Office Manager

Heesen Yachts North America

Thom Conboy Agent North-America, Mexico, Bahama's & Caribbean